Where Is IoT in the Hype Cycle, and What Does It Mean for New Adopters?

Understanding where IoT is in its hype cycle isn't just a thought exercise. It can have major implications for how you think about solving customer problems by deploying connectivity in your solutions.

Ready to build your IoT product?

Create your Particle account and get access to:

- Discounted IoT devices

- Device management console

- Developer guides and resources

Every technology comes with its own distinct promises. Sometimes those promises are realistic and achievable, and other times they're nothing more than hype.

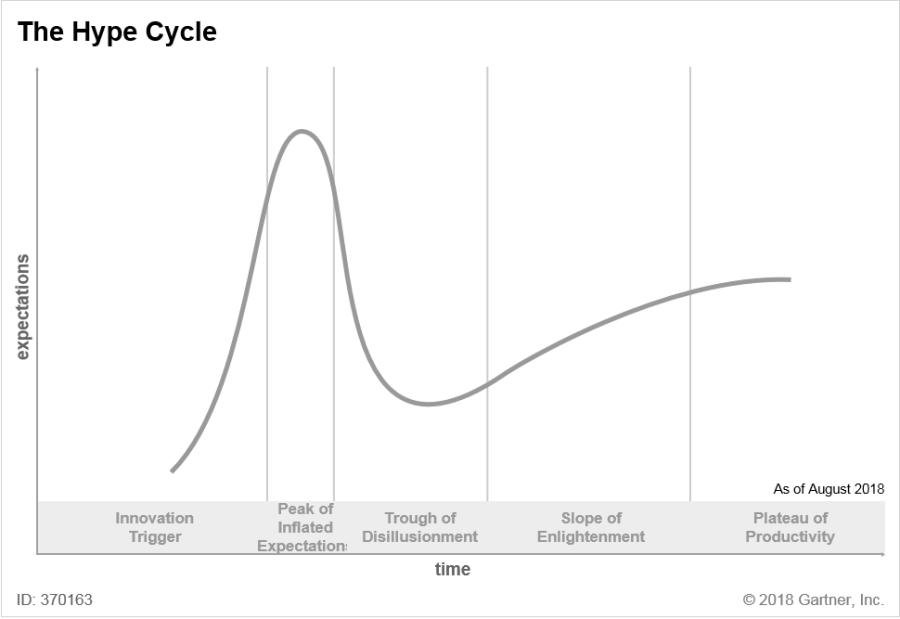

The Gartner Hype Cycle is one of the best tools we have to make educated bets on which technologies will surpass early expectations and gain traction as true innovation.

It’s a graphical representation of the progression of innovation that starts with early enthusiasm, moves through stages of disillusionment, and eventually culminates in a clear understanding of the technology's role in both its market and the world.

Gartner developed the Hype Cycle to provide us with a methodology through which to determine where a technology is in the cycle, how it might evolve, and when we can expect it to reach its potential.

It’s not abundantly clear where the Internet of Things is in the Hype Cycle. That's what we're hoping to determine today because the answer will help you understand whether investing in IoT is table stakes for your industry, or if adopting it can unlock true differentiation and competitive advantages.

Where Is IoT in the Hype Cycle?

It’s important to understand that IoT doesn’t have one single Hype Cycle. Because there are so many IoT use cases across such a diverse range of industries, you need to approach this question on an industry-by-industry basis.

Overall, we believe IoT is early on the Slope of Enlightenment. Excitement around IoT reached its peak prior to the 5G marketing boom, and in many ways, has receded into the background since—even as many industries continue to adopt the technology.

Here's a rough timeline of IoT's journey through the Hype Curve as we see it.

2012-2015

We see 2012 to 2015 as the period when IoT was at the Peak of Inflated Expectations. At that time, a major IoT surge yielded a lot of investor money for consumer-focused companies like Nest, and every tech publication was buzzing.

2015-2018

By 2015, the consumer IoT industry hit the Trough of Disillusionment when we all realized that a lot of consumer products don’t really need to be connected. At the time, there just wasn’t enough value in connectivity for most of the products on the market. (Looking at the refrigerator with the giant screen on it here.)

2018-2022 and beyond

Since 2018, industrial and business-to-business use cases have represented IoT’s big comeback. We’re seeing companies in "unsexy" industries like HVAC, industrial monitoring, energy production, etc. starting to adopt IoT for a variety of use cases—not to mention a rise in relatively new industries like micromobility that only exist because of IoT. You can even look at Samsara’s recent IPO as an indicator that IoT for business applications is gaining serious traction.

Simply put, context matters, and that’s why it’s hard to say where IoT is in the Hype Cycle. Let's look at it through the lenses of a few different industries.

Consumer IoT

Smart thermostats and the few other successful consumer IoT categories have essentially plateaued for now. They work, they have wide adoption, and they have more or less become the default option in their categories. You wouldn’t build a brand new home with a dumb thermostat.

There might be some more progress to be made with integrated smart home solutions, such as those that bundle home security and energy management, but for most practical purposes, consumer IoT products have reached the Plateau of Productivity phase.

Micromobility

Micromobility is climbing out of the Trough of Disillusionment, shaking off the bad press from a bevy of failed startups, realigning after widespread overinvestment, and repairing relationships after pissing off city officials and residents by dumping vehicles all over the place.

Now, startups in this space are leveraging IoT to adhere to standards like the Mobility Data Specification, partner with cities in more mutually beneficial ways, and use connectivity to build differentiation into their products. In short, the micromobility industry is being built on IoT.

Nascent Use Cases

Because use cases like methane emissions, HVAC, and industrial monitoring are just getting started with IoT, they’re not quite on the Slope of Enlightenment yet. However, early adopters have gained some ground and others are beginning to follow.

What Can You Learn From IoT’s Early Adopters?

IoT early adopters made a bet on the technology being a differentiator before they knew if their gamble would pay off—and we like to think their confidence has been rewarded, as many of them are now leading their industries.

To be clear, though, IoT is still in its early days for most industries and use cases, so you haven’t been left behind! In fact, you can take what early adopters learned the hard way and apply this knowledge to your own IoT projects.

Broadly, these learnings can be broken down into three core lessons:

IoT Is Hard

Early IoT adopters across industries quickly learned how hard it is to build a connected product, even when the use case is fairly basic. We often hear from people who think, "You have a machine or device, you add a web or mobile app, and then you have an IoT product," but anyone who's built an IoT product from scratch knows how naïve that is.

IoT is deceptively simple, but there’s a very complex middleware layer between the user interface and the edge devices. The under-the-hood complexity of connectivity, security, networking, SIM cards, scalability, etc. goes unnoticed in a great IoT product because it all just works.

In our experience, most companies that are new to IoT end up vastly underestimating the resources they'll need for a successful deployment. They hire too few engineers, set super-aggressive timelines, and rarely understand the scope of the project. Inevitably, they start missing milestones because their FCC certification gets rejected, they can't prove ROI, their change management efforts failed, etc.—and then they give up. As a result, most in-house IoT projects fail.

To put this into perspective, we recently met with a founder who was part of a successful consumer IoT company and had left that organization to launch a new IoT product. We asked why, as one of the few people in the world who's successfully brought an in-house-built IoT product to market, he was considering working with Particle.

His response? "I never want to do that shit again."

IoT Makes You Think Like a SaaS Company

In the past, manufacturers would almost never see their products once they were purchased. Today, they can use IoT to track their products' usage patterns, location, and failure states, just to name a few.

To understand the implications of this, think about how a SaaS company works. With SaaS, you can track almost any product-related user interaction and event. IoT enables companies that sell physical products or assets to do the same thing. This information can be fed back to the product team to facilitate iteration and build new functionality based on actual product usage.

IoT Changes Every Aspect of a Business

It’s easy to get caught up in thinking that IoT is only for IT, product, and engineering teams—but what early adopters have learned is that IoT fundamentally changes the way a business operates across the board. For instance:

- Your sales and marketing teams need to understand how to position connectivity as part of a go-to-market strategy.

- Your supply chain/logistics teams need to know how to respond to a failing machine or product, with the goal of acquiring and incorporating new parts before the end user notices.

- Your finance team needs to understand how to realize recurring revenue from connected products.

IoT is a technical solution to a business problem, so true IoT adoption means embracing how it changes every aspect of your business.

Is IoT Already Table Stakes? Can You Still Find Competitive Advantages?

Whether IoT is considered table stakes or a competitive advantage depends on a particular industry's adoption curve.

For example, micromobility—particularly the light electric vehicle space—is built on IoT, and the fleet tracking and automotive industries are also pretty far along in their adoption. In contrast, industries like emissions monitoring, HVAC, and industrial equipment are surprisingly far behind. Micromobility literally wouldn't exist without connectivity, whereas simply offering connectivity can be a major differentiator in an industry like HVAC.

However, in small markets with a few major players, IoT alone isn't enough to build a sustainable competitive advantage. For instance, Jacuzzi® Hot Tubs is currently a hot tub market leader because it’s the only provider that uses cellular connectivity rather than Wi-Fi. Its connected hot tubs are a lot more reliable than its competitors' offerings, which depend on the strength of customers’ Wi-Fi—but this will only be a differentiator for so long.

Once other players adopt cellular connectivity and the rest of the market catches up, differentiation will become about offering connectivity plus a special value proposition that competitors don’t or can’t have.

We see there being three distinct phases of IoT innovation that can lead to durable competitive advantages, especially in industries where IoT is or is becoming table stakes.

Phase 1: Connectivity and Remote Control

The first phase is about laying the groundwork so you have reliable connectivity, you’re able to push over-the-air updates, and you can remotely control your assets and their individual components.

For Jacuzzi® Hot Tubs, this means empowering users to adjust their hot tubs' temperature, jet pressure, and other factors via their smartphones. Connectivity also enabled Jacuzzi® Hot Tubs to monitor its hot tubs and provide preventative service and maintenance as needed. In Phase 1, Jacuzzi® Hot Tubs enjoys a portfolio of advantages that gives it a competitive edge over the other players in its space.

Phase 2: Differentiation

As IoT becomes more widely adopted within an industry, a company that once set itself apart simply by offering connectivity will find that that's no longer enough. In Phase 2, competitive advantages and differentiation are the name of the game.

Phase 2 is where you start to build something distinctive that goes beyond remote control—for example, a product that "learns" via machine learning. (Think of how a Nest thermostat learns your preferences based on usage patterns.)

Another example would be what Qube has built in the emissions monitoring space. Qube's fleets of connected sensors use proprietary algorithms that can detect emissions' precise location, quantity, and type to help energy producers prioritize fixes. In other words, connectivity is only a small part of what makes Qube unique—it's what the company does with that connectivity that’s the real value driver.

Read the full case study to learn how Qube built a leading continuous emissions monitoring solution with Particle.

Ultimately, Phase 2 is about having connectivity plus additional value propositions that your competitors can't easily copy simply by connecting their own devices.

Phase 3: IoT as a Business Model

Phase 3 is where IoT and IoT-enabled service models become the core of your business model.

This phase isn't just about product features and functionality, but a total evolution of your business model. In Phase 3, you don't sell machines or physical assets—you sell usage of your product that gets measured via connectivity.

Say you sell CNC machines for industrial manufacturing. The "old" way of selling machinery is to make one-off or bulk sales, maybe with a time- or usage-based service plan added on. Under this approach, you sell the machine, the customer owns it, and it becomes the customer's depreciating asset to manage.

IoT completely changes that business model. Instead of selling a depreciating asset, you can provide customers with machinery at little to no upfront cost by charging a recurring fee for usage. This model is mutually beneficial: You've decreased the barrier to invest in capital equipment and lowered the customer's operating expenses while creating a recurring revenue stream that lasts for the life of the asset.

By aligning your incentives with those of your customers, you're essentially selling uptime. Your customers only pay you if the machinery is working properly, and you have the power to track machine usage and condition. You can price in condition-based preventive maintenance and give your customers the confidence they need to buy on a subscription basis.

With IoT, the fundamentals of your business shift—everything from how you design your products and manage your supply chain to how you recognize revenue. IoT is a path to higher customer lifetime value, deeper relationships with customers, and a decreased risk of losing customers during replacement cycles.

What Does IoT Need to Overcome to Accelerate Adoption?

At Particle, we're constantly looking for ways to help more companies make IoT part of their DNA without having to become IoT experts themselves.

Particle started out with an intense focus on serving the IoT developer community—we wanted to democratize IoT by making devices, connectivity, and software simple and easy to adopt. As we grew and started working with Fortune 500 companies, we realized that this mission of democratizing IoT still holds true… even for some of the biggest companies in the world.

Most enterprises have teams that are extremely technically proficient in their domains. That said, this doesn't always translate into being technically proficient with IoT, and our customers' customers are often even less IoT-savvy.

This raises some key questions:

- How do we help teams that have no special IoT proficiency build market-ready connected products?

- How do we make the value of IoT understandable for our customers—and, by extension, their customers?

We're answering those questions by taking a Platform-as-a-Service approach to the middle layer of IoT. We handle all the really hard parts, such as OTA updates, device management, certifications, global connectivity, and other things that are usually stumbling blocks for enterprises trying to build their own IoT products.

Making this middle layer affordable and simple to implement accelerates IoT adoption by giving companies the bandwidth to solve customer problems and find ways to deliver value. In other words, we make IoT easy so our customers can focus on making their own customers' lives easy.

Take our customer Watsco, a leader in the HVAC equipment industry that initially struggled to introduce connectivity to its products. When it was building IoT solutions in-house, Watsco frequently ran into OTA update issues and struggled to ensure reliable connectivity.

Building on Particle's platform allowed Watsco to solve those problems, which freed up the company to focus on building a pipeline of products that solved its HVAC contractor customers' problems.

Check out the full case study where you can see exactly how Watsco revolutionized its business with IoT.

When IoT is Easy, What Will Still Be Hard?

Early IoT adopters' big bets are paying off, and the knowledge they’ve generated is making it easier than ever for newcomers to skip the hard parts and start building connected products.

Although IoT may seem like it's been around for a while, it's still nascent in many industries. Looking to the future, it'll become trivially easy to build IoT into a product, gather valuable and usable data, and bring about pricing and service transparency. At that point, companies' offerings won't be "IoT products"—they'll just be products with the functionality that customers expect.

This is where IoT will get really exciting. As platforms like Particle facilitate IoT implementation, the frontrunners will move through the three phases of innovation faster. When relying on connectivity alone is no longer enough to differentiate themselves, they'll win by being good at the stuff that will always be hard: finding product-market fit, developing a sound go-to-market strategy, and managing change within their organizations.

The Authors

![Zach Supalla]()

Zach Supalla

CEO and co-founder, Particle

![dan headshot]()

Dan Jamieson

COO, Particle